Operationalizing IoT in Insurance

Report Summary

March 2018 - Internet of Things (IoT) initiatives are of keen interest to insurers. While overall deployment is fairly low, the sensor and connectivity technology that enables IoT continues to improve. Insurers will likely need to address IoT in the coming years, even if many are taking a “fast follow” approach.

March 2018 - Internet of Things (IoT) initiatives are of keen interest to insurers. While overall deployment is fairly low, the sensor and connectivity technology that enables IoT continues to improve. Insurers will likely need to address IoT in the coming years, even if many are taking a “fast follow” approach.

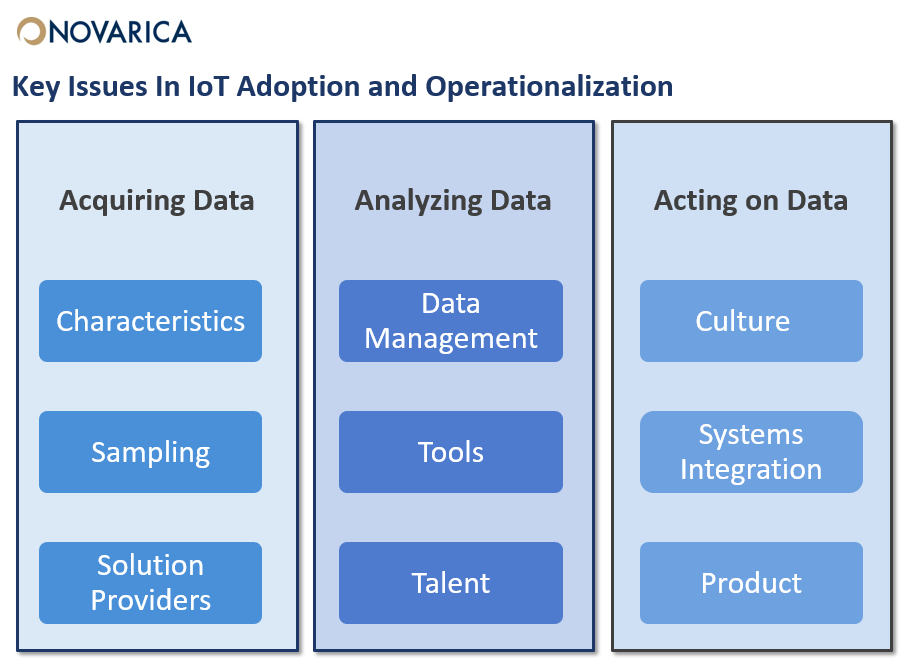

Operationalizing IoT products introduces complexity beyond traditional pricing and service issues. Full IoT deployment requires sophisticated sampling and analytics capabilities, and many carriers struggle with how to begin initial pilot programs or how to move from pilot phases into more complex products and services.

Key Points and Findings

- IoT has low deployment but high interest among insurers; deployment rates are likely to grow. Only 10% of insurers have currently-deployed IoT programs, but about a quarter are planning pilots and almost half are closely watching the area.

- Bundled services are a key component of the IoT value proposition. IoT enables value-added services that can both draw customers and help carriers offset the costs of IoT programs.

- Carriers can start small, with plans to enhance capabilities. Carriers can gain access to scored IoT data through vendors to experiment with incorporating key metrics into products. As these carriers gain experience and build out big data capabilities, product complexity can increase.