Most of the Novarica 100 Framework covers digital, data, and core capabilities in functional areas that pertain to the insurance business cycle. There are also four additional capabilities specific to the operations of IT to round out the even 100. These include:

- MVP Deployment, an Agile development principle that focuses on deploying a minimum viable product (MVP) or digital experience and iterating on it with subsequent enhancements and modifications.

- Robotic Process Automation (RPA), or using software and algorithms to automate simple, repetitive sub-processes.

- IT Financial Management, whereby IT tracks and communicates resourcing, costs, accounting implications, and business cases at a granular level.

- Modern DevOps Practices, including continuous integration, automated testing, dev/test/prod environments, push-button machine imaging, etc.

These final four capabilities aren’t parsed according to digital, data, or core. As practices, they’re things that IT departments either do or don’t do. RPA is more a capability than a practice, but it can be applied to most simple, repetitive sub-processes in any functional area, so it can help enable efficiencies across data, digital, and core.

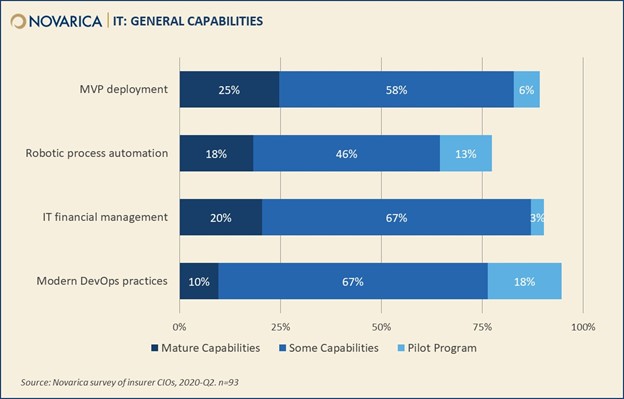

More than three quarters of insurers have deployed these practices in some capacity or are planning pilots. But maturity levels overall are low, which suggests that most are experimenting with these capabilities, rather than embracing them.

Most insurers practice MVP deployment, which matches the increasing rate at which insurers have adopted Agile. Few organizations are fully Agile, though, and levels of maturity can vary substantially. Some insurers have had success creating Agile practice groups to formalize definitions and train staff, such as Amerisure, which won a 2020 Novarica Impact Award for its work in this area.

Similarly, most insurers have adopted some form of DevOps, although this is a bit less broad than Agile and substantially less mature. Like Agile, DevOps can help insurers break down internal silos and create operational efficiency.

Insurers are using IT financial management to gain clarity around IT costs while also demonstrating the value IT creates. As with Agile, IT financial management has multiple levels of maturity, and few insurers have fully optimized it.

RPA is currently the least-developed of these capabilities, but its use among insurers has been increasing rapidly for several years. It’s a useful tool for speeding established processes, since it can be deployed relatively quickly and doesn’t require extensive process reengineering. However, RPA isn’t a permanent solution to more entrenched technology issues—it simply makes them less glaring for a while.

The N100 framework is also available as a self-rating tool for insurers; if you’re a Novarica client or Research Council member interested in benchmarking your company, feel free to contact [email protected] to receive a copy.

Add new comment