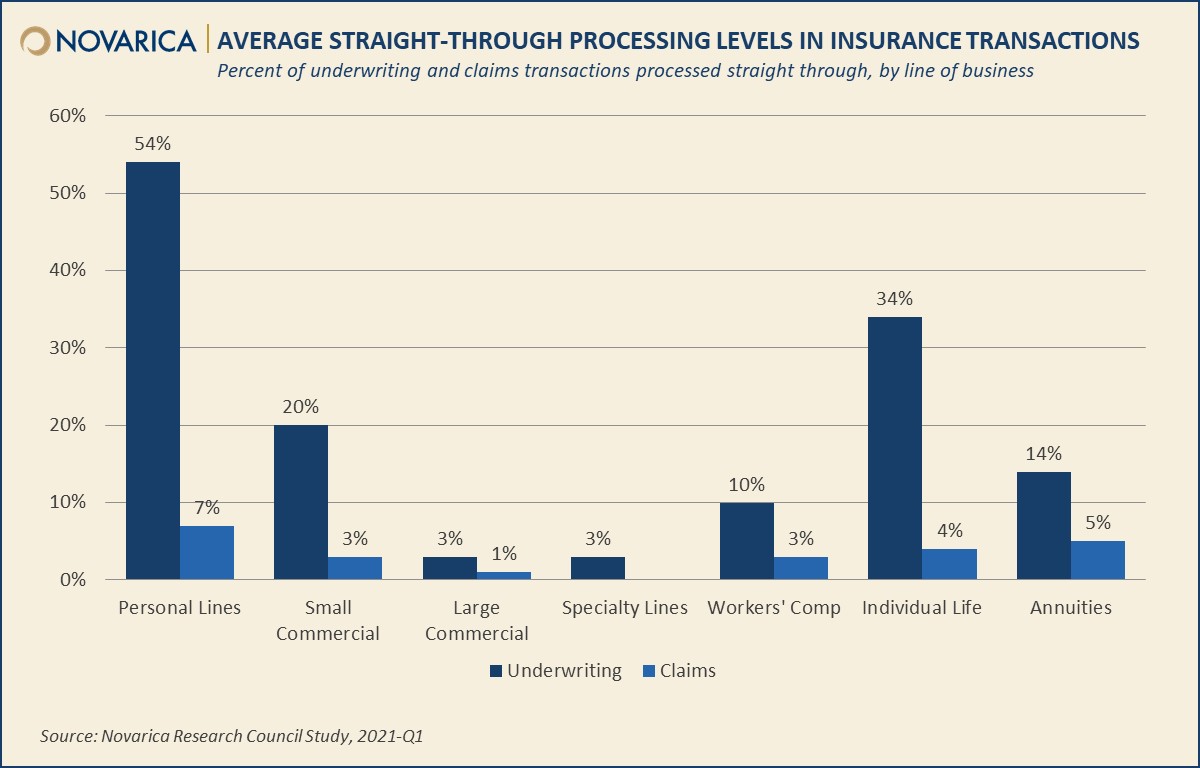

February 2021 – Straight-through processing (STP) is becoming more common in insurance underwriting and payment processes. Particularly in personal lines, individual life, and small commercial—lines which are under cost pressures and are increasingly sold directly—many insurers have enabled some level of STP. Adoption rates in more complex lines and in claims processes remain relatively low.

This report tracks STP in underwriting, claims, and digital payment transactions across seven major insurance business lines.

Key Points and Findings

- Straight-through processing is strongly associated with lines sold directly. Insurers have achieved the highest levels of automation in personal lines and individual life products.

- Few insurers have automated claims processes. For some lines of business, complexity of claims processing has inhibited automation; for others, this is an opportunity for innovation.

- Digital claims payment automation is highly variable. Digital payments can be customer experience differentiators, but many insurers still rely on paper checks for most transactions.

About the Author

Harry Huberty

Harry Huberty is the Research Director for the Insurance Practice at Datos Insights, where he manages the Research Council, a moderated knowledge-sharing community of over 400 insurer senior executives. He also leads Datos Insights’s research on automotive telematics in personal and commercial lines. He holds an MTS in Religious Studies from Harvard Divinity School and a B.A. in Religion from...