Boston, December 2, 2021 – Virtual cards have exploded onto the payments scene over the last few years, but many businesses and corporate entities remain unclear about what virtual cards really do and how these cards can help their organization. This lack of understanding is hindering growth for existing virtual card issuers and payment providers but creates opportunities for payment providers that can help businesses navigate their misconceptions.

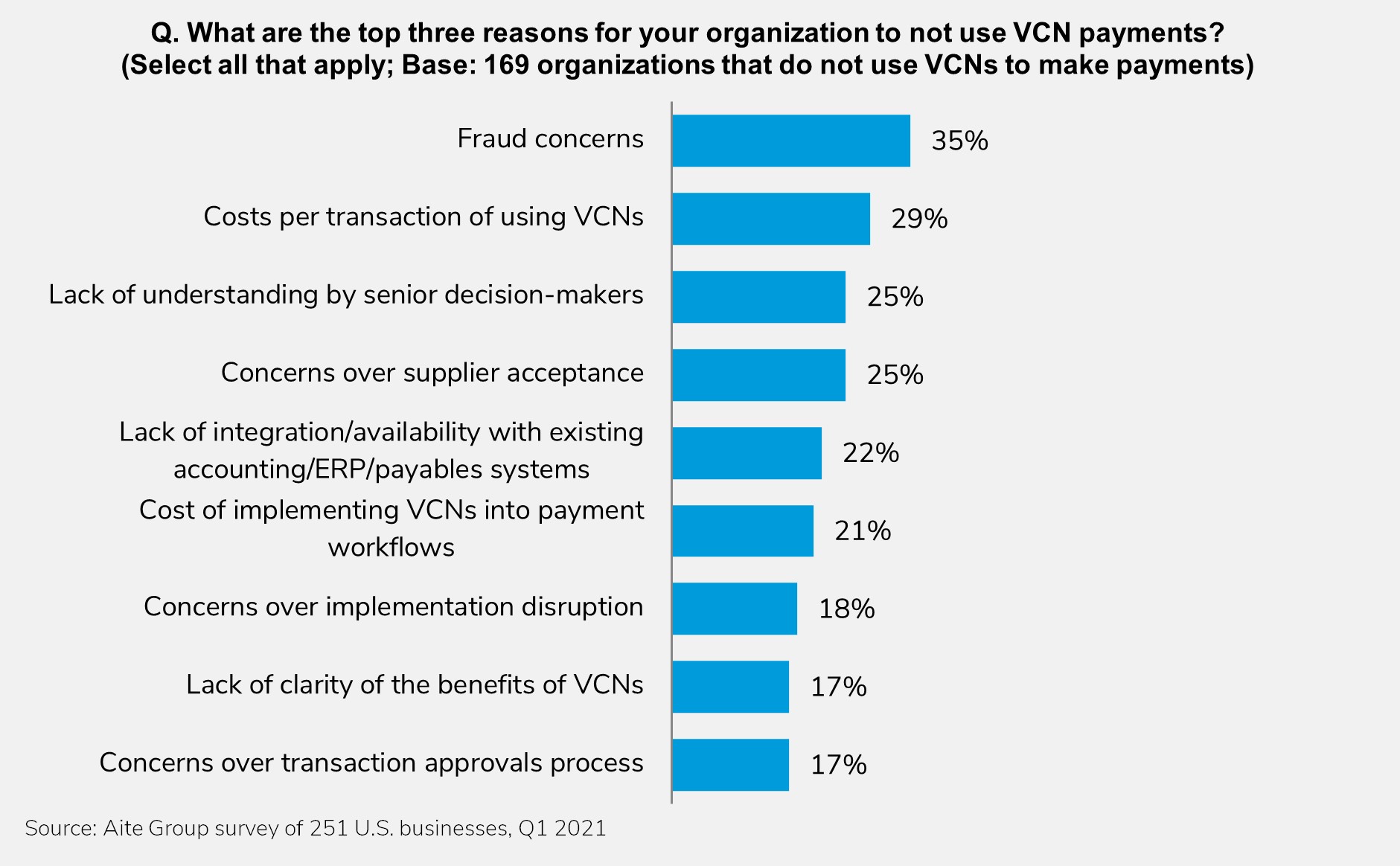

This Impact Report provides insight into the views of a range of organizations, from small businesses to large corporations, on virtual cards and helps issuers more effectively target these customers. It is based on a quantitative survey, sponsored by Discover Global Network, of 251 payment decision-makers with small, midsize, and large enterprises in the U.S., which was conducted in Q1 2021, and is backed up by a series of qualitative interviews with industry stakeholders.

This 18-page Impact Report contains four figures and one table. Clients of Aite-Novarica Group’s Commercial Banking & Payments service can download this report and the corresponding charts.

This report mentions American Express, Discover, Mastercard, SAP Ariba, Tradeshift, Tungsten Network, U.S. Bank, and Visa.

About the Author

Gilles Ubaghs

Gilles Ubaghs is a Strategic Advisor with the Commercial Banking & Payments practice at Datos Insights, where he is focused on business-to-business and commercial payments as well as the role of digital transformation across the enterprise and broader financial services sector. Gilles brings over 15 years of experience in the analysis and financial services space creating a range of syndicated off-the-shelf and...