Augmented and Virtual Reality: Potential Use Cases for Insurers

Report Summary

August 2017 - Augmented Reality (AR) and Virtual Reality (VR) are among many evolutionary technologies making inroads into conversations at all levels of technology leadership. These separate and distinct technologies may represent another channel through which insurance companies can serve digitally immersed stakeholders. They have potential real-world implications that span risk mitigation, improved efficiency and loss ratios, and enhanced customer experience. The effect of VR and AR on the insurance industry will be most impactful over time, and their potential to influence and enhance the customer experience is thought-provoking.

August 2017 - Augmented Reality (AR) and Virtual Reality (VR) are among many evolutionary technologies making inroads into conversations at all levels of technology leadership. These separate and distinct technologies may represent another channel through which insurance companies can serve digitally immersed stakeholders. They have potential real-world implications that span risk mitigation, improved efficiency and loss ratios, and enhanced customer experience. The effect of VR and AR on the insurance industry will be most impactful over time, and their potential to influence and enhance the customer experience is thought-provoking.

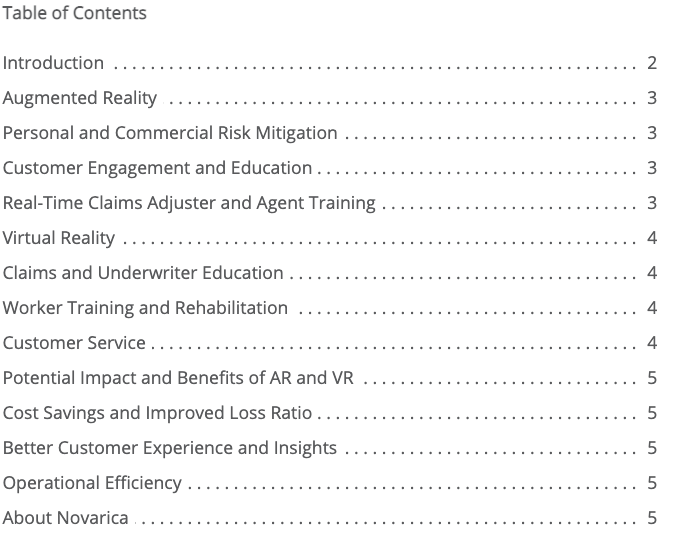

This brief outlines the current state of VR and AR, and potential use cases for these technologies in the insurance industry.