As we approach the end-of-year holidays, the drum of M&A activity seems to be beating stronger as companies realign their assets and refine go-to-market strategies. This past week saw two significant announcements, both of which carry implications for life insurance carriers.

In terms of size and scale, it would be hard to beat the announced consolidation of discount brokerage titans Charles Schwab and TD Ameritrade. The $26B deal creates a company that can create significant economies of scale at a time when the race is on to drive trade costs down toward zero. As the retail investment business witnesses a decomposition of the traditional business model, paying for trades is far less important than the opportunity to generate revenue from managing assets at very large volumes—while concurrently supporting a business model where the monetizable value-added service is advice.

Recognizing the value of advice, of course, creates different opportunities for companies that are focused on either different value propositions or market niches. All of this has implications for both broker-dealers owned by insurance carriers and their product manufacturing arms that are seeking shelf space for the future. Fewer shelves in bigger “stores” could be a consequence, which could affect how the business will evolve in the next decade. I addressed some of these considerations recently in a blog post highlighting the importance of scale in certain segments of the industry. Challenges and opportunities for broker-dealers were also the subject of a recent blog, which also highlighted the impact of consolidations on the supplier market.

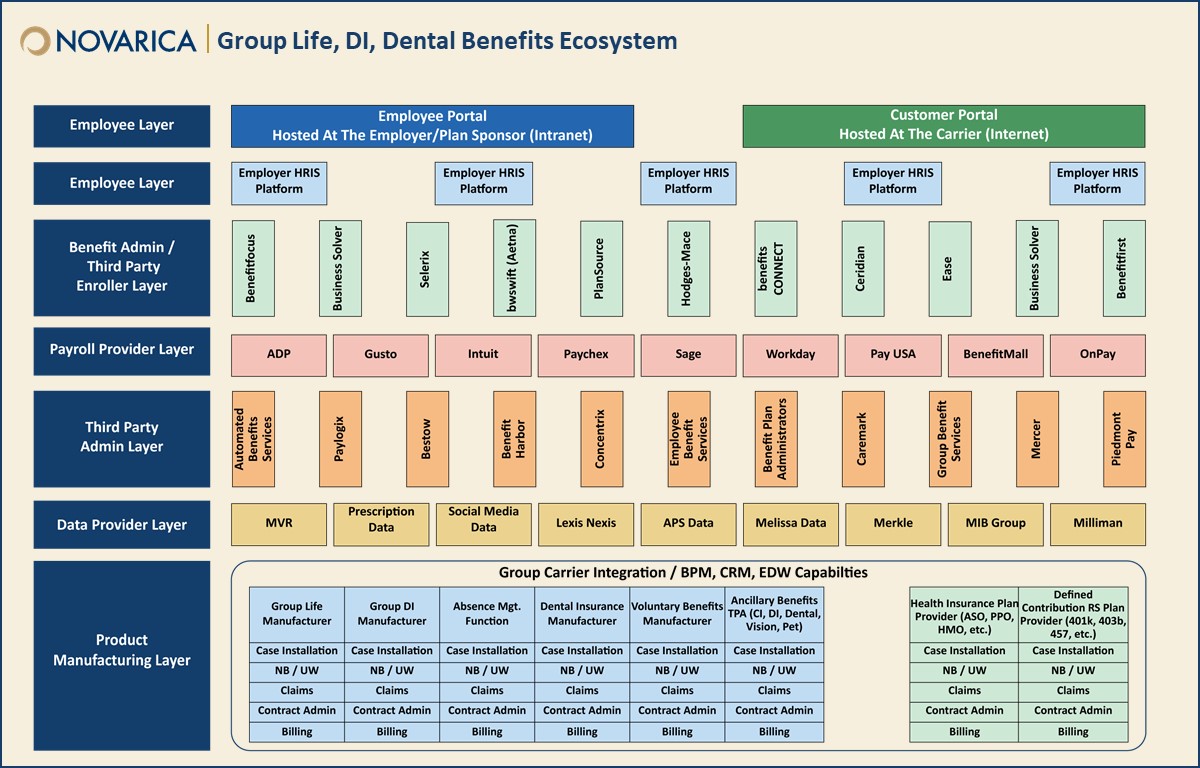

A completely different type of merger announcement, which was easy to miss with the news of the Schwab mega-deal, has implications in the group/voluntary benefits part of the insurance world. Securian announced the acquisition of Empyrean, a benefit administration platform that is a key player in the employee benefits ecosystem. Sitting between product manufacturers and plan sponsors (e.g., employers), the bene-admin players have taken on significant increased importance over the past decade, in effect creating the “stores” through which a wide array of benefits are made available to plan participants (e.g., employees). One of the increased challenges group/VB carriers have faced is that they have steadily lost market and relationship control as new entrants have helped to disintermediate traditional markets.

Instead of trying to build more scale through horizontal acquisitions, along the lines of what The Hartford and Lincoln Financial did with their respective transactions in 2018, this transaction implies a vertical integration where Securian will have a chance to play in a deeper swath of the benefits ecosystem. This implies that they will compete against not only other carriers for the manufacturing role, but also against other bene-admin and solution providers (e.g., Benefitfocus, Workday, ADP) that have also looked to expand capabilities outside of their traditional “swim lanes.” The competitive opportunities, and threats, for others could be notable.

The vertical integration suggested by the Securian transaction seems more akin in type, not scale, to Aetna’s tie-up with CVS, which was also approved in 2019. New business models, new opportunities for leverage, drives to improve margins, and efforts to solidify position are part of the ongoing preparations for a world where investments in technology will take on increased importance in the drive to meet evolving customer expectations. Strap in! 2020 looks to offer a fascinating ride.

Add new comment