A new survey of over 100 insurer CIOs finds that while there is an active interest in a wide range of tools and technologies that fall under the “emerging” label, there is still considerable diversity in both deployment rates and active plans for pilot programs. Deployment of this emerging technology is still rare, with adoption rates of fewer than one in four insurers, but all are poised for rapid growth.

A new survey of over 100 insurer CIOs finds that while there is an active interest in a wide range of tools and technologies that fall under the “emerging” label, there is still considerable diversity in both deployment rates and active plans for pilot programs. Deployment of this emerging technology is still rare, with adoption rates of fewer than one in four insurers, but all are poised for rapid growth.

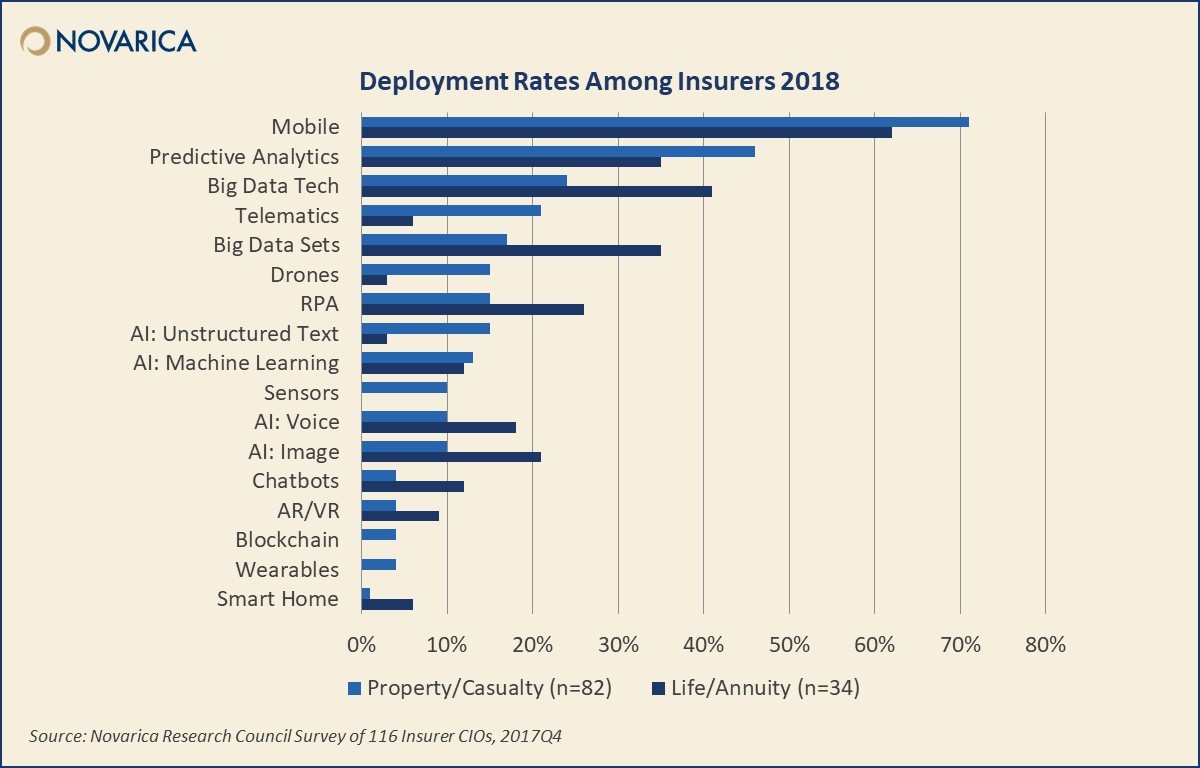

A dozen new technology areas are classified as emerging: artificial intelligence, augmented and virtual reality, big data, blockchain, chatbots, drones, mobile, predictive analytics, robotic process automation, sensors and telematics, smart home, and wearables.

At one end of the range of these technologies are mobile and predictive analytics, which are approaching ubiquity, and nearly all insurers will have experience with these areas by the end of 2018. The other end of the spectrum includes technologies that are brand new or have low consumer adoption, and so are not generating much interest from insurers yet. Technologies like augmented and virtual reality, blockchain, smart home automation, and wearables are still over the horizon for most insurers.

Most of the reported pilot activity is in digital and analytics areas like artificial intelligence, big data, sensors, drones, RPA, and chatbots. These technologies are of interest to carriers to make improvements in risk selection, claims, service, and operating efficiency. Emphasis also varies depending on the insurance sector: property/casualty insurers are more likely to focus on underwriting and claims, and life/annuity insurers are more focused on marketing and service.

Technology changes faster than culture and practice at most insurance companies. Carriers looking to fully leverage emerging technologies need to look at their products and processes in light of new technical, market, and customer realities. The growth of these capabilities should lead to improved risk selection, streamlined processes, and better business results for insurers in 2018 and beyond.

More on this can be found at: https://dev-novarica.pantheonsite.io/emerging-technology-in-insurance/.

Add new comment